Meaning, even though our business earned $60,000 in October (as reported on our income statement), we only actually received $40,000 in cash from operating activities. Keep in mind, with both those methods, your cash flow statement is only accurate so long as the rest of your bookkeeping is accurate too. The most surefire way to know how much working capital you have is to hire a bookkeeper.

The Difference Between a Balance Sheet and a Cash Flow Statement

- Therefore, the final balance of cash and cash equivalents at the end of the year equals $14.3 billion.

- This value shows the total amount of cash a company gained or lost during the reporting period.

- LO 16.3Use the following information fromChocolate Company’s financial statements to determine operating netcash flows (indirect method).

- As we have discussed, the operating section of the statement of cash flows can be shown using either the direct method or the indirect method.

- You received the following information from Hema Enterprises Pvt.

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting tax implications of equity supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com. For items 19 – 30 indicate whether they will have a positive or negative EFFECT ON CASH.

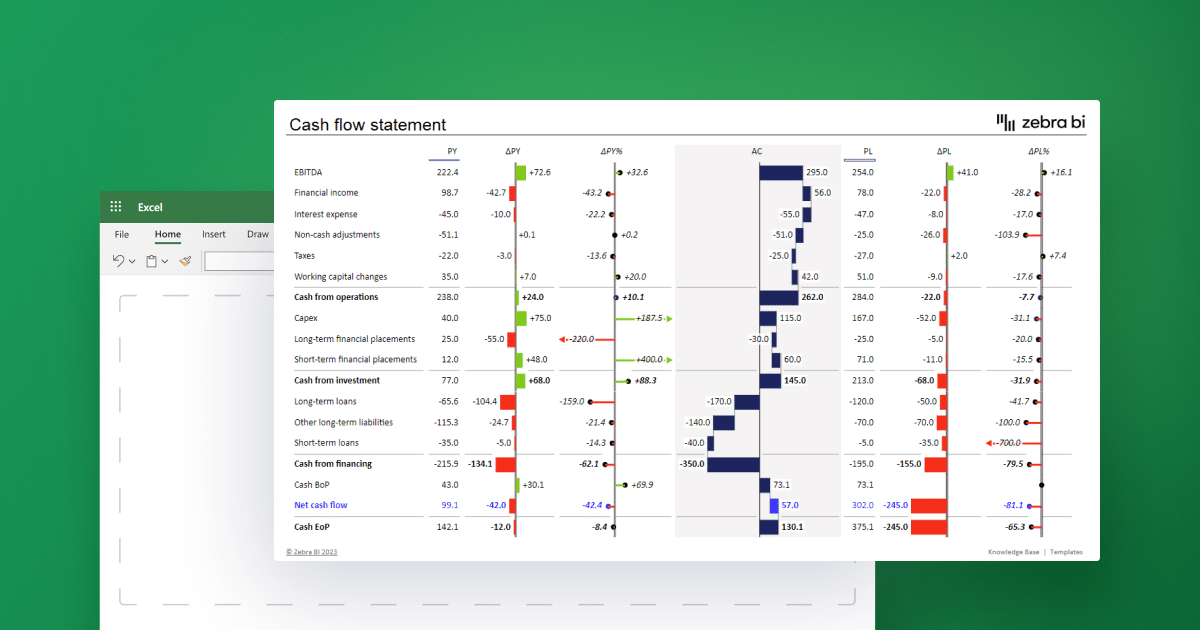

Statement of Cash Flows Example

Cash-out items are those changes caused by the purchase of new equipment, buildings, or marketable securities. It produces what is called the net cash flow by breaking down where the changes in the beginning and ending balances came from. If you can read an income statement, you can read your business. If we only looked at our net income, we might believe we had $60,000 cash on hand.

How to Enhance Decision-Making with Financial Statements

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Financial Accounting

LO 16.3Use the following information from GrenadaCompany’s financial statements to prepare the operating activitiessection of the statement of cash flows (indirect method) for theyear 2018. LO 16.3Use the following information from EiffelCompany’s financial statements to prepare the operating activitiessection of the statement of cash flows (indirect method) for theyear 2018. LO 16.3Use the following information from DubuqueCompany’s financial statements to prepare the operating activitiessection of the statement of cash flows (indirect method) for theyear 2018.

When you tap your line of credit, get a loan, or bring on a new investor, you receive cash in your accounts. Depreciation is recorded as a $20,000 expense on the income statement. Since no cash actually left our hands, we’re adding that $20,000 back to cash on hand. Using the cash flow statement example above, here’s a more detailed look at what each section does, and what it means for your business. The direct method takes more legwork and organization than the indirect method—you need to produce and track cash receipts for every cash transaction.

Cash flow statements are important as they provide critical information about the cash inflows and outflows of the company. This information is important in making crucial decisions about spending, investments, and credit. With the indirect method, you look at the transactions recorded on your income statement, then reverse some of them in order to see your working capital. You’re selectively backtracking your income statement in order to eliminate transactions that don’t show the movement of cash. When your cash flow statement shows a negative number at the bottom, that means you lost cash during the accounting period—you have negative cash flow.

Therefore, companies typically provide a cash flow statement for management, analysts and investors to review. After calculating cash flows from operating activities, you need to calculate cash flows from investing activities. This section of the cash flow statement details cash flows related to the buying and selling of long-term assets like property, facilities, and equipment. Keep in mind that this section only includes investing activities involving free cash, not debt.

Síguenos: